Alternative-energy stocks skyrocket amid renewed optimism about the industry

As reported by Claudia Assis from MarketWatch, stocks directly involved or connected to alternative energy are riding high in Wall Street’s opinion, enjoying share gains that in some cases rival or surpass the meteoric rise and widespread appeal of Tesla Inc.’s shares.

Analysts point to backlashes against power outages, climate-change risk, hopes of riding on the coattails of Tesla TSLA, +0.18% stock, and recent building-code mandates against natural-gas hookups as some of the reasons behind their newfound popularity. Moreover, some believe it will last this time around.

Earlier Thursday, shares of Plug Power Inc. PLUG, +1.09% rose to a five-and-a-half-year high after the maker of hydrogen fuel cells used in forklifts and other warehouse equipment announced a partnership to build zero-emission commercial trucks.

Shares of Plug Power have jumped more than Tesla’s in the past 12 months — a 192% advance that compares with Tesla’s 190% and the S&P 500 index’s SPX, -1.05% 20% in that time span.

On a list of 100 most popular stocks on trading platform Robinhood, Plug Power comes in ahead of Tesla, and is also ahead of heavyweights such as Facebook Inc. FB, -2.05%, Advanced Micro Devices Inc. AMD, -6.97% and many others.

Tesla got a nod on Wednesday not for its vehicles, but rather its solar-power and energy storage business from analysts at Piper, who described the “illuminating” results of having a Tesla-installed solar-power system to power a Tesla vehicle.

Tesla shares topped $900 on Wednesday, and were down around 4% on Thursday after gains of more than 14% in the two previous sessions combined.

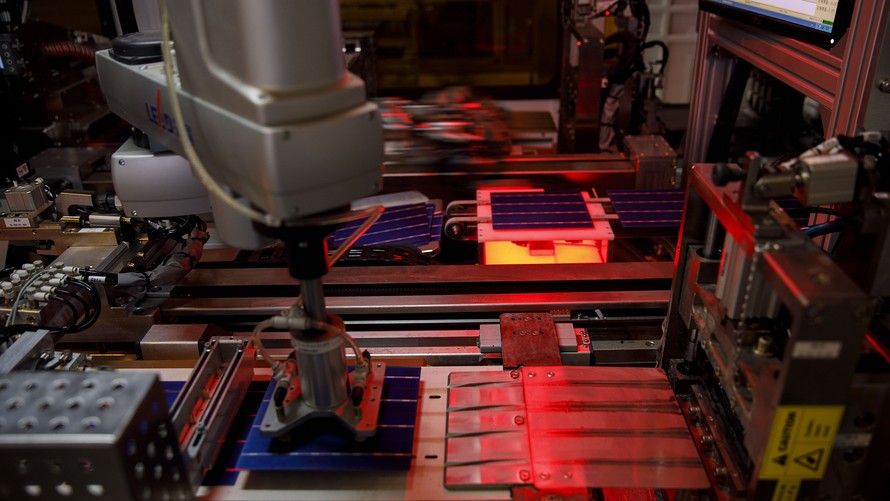

Analysts at J.P. Morgan said in a note Thursday their top picks among alternative-energy stocks are First Solar Inc. FSLR, -14.72%, SolarEdge Technologies Inc. SEDG, -0.09%, and Sunnova Energy International Inc. NOVA, -7.51%.

They also have the equivalent of buy ratings on Bloom Energy Corp. BE, -7.39%, Enphase Energy Inc. ENPH, +0.60%, Hannon Armstrong Sustainable Infrastructure Capital Inc. HASI, +2.83% and SunRun Inc. RUN, -6.20%

SolarEdge stock also outpaces Tesla shares in a 12-month snapshot, up 218%. The shares garnered a slew of price-target increases in recent days, including a Thursday upward revision from Angelo Zino with CFRA, who bumped his target to $140 from $78 in part “to reflect (SolarEdge’s) superior balance sheet (net cash per share of $8.73) and potential expansion into new addressable markets,” he said in a note.

SolarEdge late Wednesday reported adjusted fourth-quarter earnings of $1.65 a share on sales of $418 million, which compared with expectations of adjusted EPS of $1.25 on sales of $414 million.